In recent months, Missouri has subtly established itself as a leader in tax policy by phasing out individual taxpayer capital gains taxes beginning in 2025. House Bill 594, which Governor Mike Kehoe signed into law, permits people to deduct 100% of capital gains from their Missouri taxable income that are reported on their federal returns. Despite its apparent technicality, this shift is having a major impact on the state’s investment and economic climate.

Missouri’s deliberate removal of the capital gains tax burden has sparked a discussion that is not only extremely pertinent to tax lawyers and accountants but also incredibly successful in energizing homeowners, investors, and business owners. This law offers what may be the largest state-level tax relief of the decade, regardless of whether you’re liquidating cryptocurrency, cashing out stock options, or selling a decades-old family home.

Residents of Missouri who intend to sell high-value assets, such as real estate, appreciated stocks, or business ownership stakes, will especially benefit from the legislation. For instance, a retired couple in Springfield can now avoid paying state taxes on hundreds of thousands of dollars in gains when they sell a farm they have owned for 40 years. Their flexibility in retirement planning could be significantly increased just by that exemption.

Missouri Capital Gains Tax – Key Policy Information

| Category | Details |

|---|---|

| Legislation | House Bill 594, signed into law July 10, 2025 |

| Effective Date | January 1, 2025 |

| Applies To | Individuals (full deduction); Corporations (conditional deduction) |

| Tax Deduction | 100% of capital gains from federal return excluded from Missouri income |

| Corporate Trigger | Deduction begins if top individual rate hits or drops below 4.5% |

| Impact Estimate | ~$430M in first year, ~$340M annually thereafter |

| Real Estate Impact | High—expected boost in sales and listings |

| Tax Planning Required | Yes—especially for high-net-worth individuals and business owners |

| State Ranking (Pre-2025) | 29th highest capital gains tax rate at 4.7% |

| Official Resource | Stinson LLP |

In contrast, citizens of states like Minnesota and California continue to pay high state capital gains taxes, which can reach 10.85% at times. Missouri takes a very different approach, and on purpose. This was presented by lawmakers as a means of increasing economic vibrancy, drawing in mobile capital, and granting citizens more authority over their financial futures.

The reform creates new opportunities for tax planning for business owners. Residents of Missouri can make sure that their profits are totally exempt from state income tax by structuring equity sales instead of asset sales. Effectively managing this will necessitate careful planning and expert counsel, particularly for companies with multi-state operations, as Charles Jensen and other Stinson LLP lawyers have pointed out.

Additionally, Missouri lawmakers added a forward-looking corporate clause out of strategic foresight. Corporations will be able to fully deduct capital gains beginning the following year if the state’s top individual tax rate drops to 4.5% or less, a target the state is working toward. That provision alludes to future systemic tax changes that are even more profound.

By adding more tax breaks for lower-income households, veterans, and seniors, lawmakers made sure the bill had wider appeal during the legislative process. In fact, it eliminated sales taxes on diapers and feminine hygiene products as part of a targeted exemption from the so-called “pink tax,” which addressed gender equity.

State tax policy has evolved into a battlefield of competition during the last ten years. States like Washington, where a new 7% capital gains tax went into effect in spite of opposition, are in stark contrast to Missouri’s decision. In light of this, Missouri’s reform seems both highly adaptable and ideologically unique, reflecting a widening gap in state definitions of economic justice and opportunity.

Missouri might be especially attractive to investors with connections to several states. Consider a wealthy person from New York who chooses to re-domicile in Kansas City. Tens of thousands of dollars that would have been lost to state taxes could now be kept by simply moving. CPAs and wealth advisors will need to read Missouri’s new rulebook.

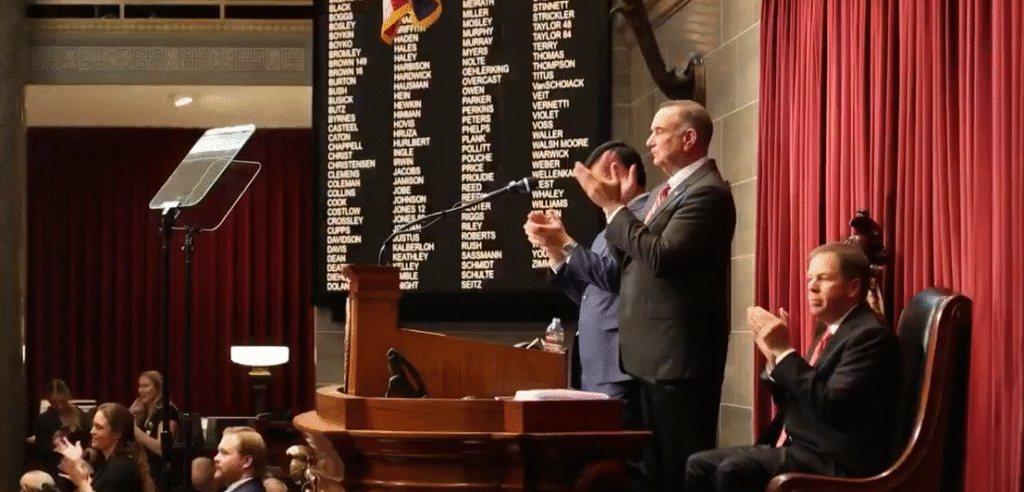

Prominent endorsements have also improved the law’s reputation. One of its designers, State Representative Perkins, referred to it as a “fairer system that rewards personal initiative.” The statistics support his assertion, even though it was laced with the customary political optimism. Because of Missouri’s drastically lower tax burden on investment profits, analysts predict a rise in real estate activity, more property listings, and possibly even more business transactions.

However, detractors wonder if the advantages are overly concentrated at the top. According to national research, the top 5% of earners report more than 75% of capital gains income. This implies that, at least initially, the typical Missourian might not experience much direct impact. The estimated yearly revenue hit of more than $300 million worries some more. Skeptics contend that if budget gaps grow, access to healthcare, infrastructure repair, and public education may suffer.

However, despite these worries, financial planners and real estate experts remain optimistic. Investment advisors have noted an increase in calls regarding moving businesses and portfolios to Missouri since the law’s passage. Especially for those who are planning multi-million dollar exits, the potential cost savings are very evident.

Missouri might have started a trend rather than just a new exemption by combining responsive policy with innovative tax design. Lawmakers in Iowa and neighboring Arkansas have already begun to consider proposals based on House Bill 594. A regional shift in capital tax policy may occur in the upcoming years if Missouri’s reform is successful and long-lasting.

Additionally, many Americans are reconsidering their financial strategy at the time of this move. Asset preservation is now of utmost importance due to rising interest rates, inflation worries, and erratic equity markets. Missouri encourages investors to reevaluate their base of operations by providing a pronounced tax advantage on gains, both literally and figuratively.

Missouri’s approach to capital gains reform is especially creative since it makes use of astute legislation and appeals to a broad range of financial interests. It lays the groundwork for a new era of tax-friendly investment environments by striking a balance between ideological clarity and tactical specificity.