Although Lisa Cook’s lawsuit against President Donald Trump is eerily reminiscent of previous conflicts between presidents and the Federal Reserve, it feels especially significant. The legal dispute has dominated financial headlines in recent days, not only because it raises questions about the Fed’s independence but also because it emphasizes how carefully politics and monetary policy must be balanced.

Although Cook has not been charged with any crimes, Trump accused her of mortgage fraud, citing conflicting filings in Georgia and Michigan. Trump is pushing the envelope in a way no president has ever done before by using a decades-old provision in the Federal Reserve Act that allows dismissal “for cause.” Cook contends that the accusations are baseless, politically driven, and a ruse to punish her for opposing interest rate reductions. Judge Jia Cobb’s courtroom is now the scene of this unprecedented confrontation, which her lawyers characterize as “unprecedented and illegal.”

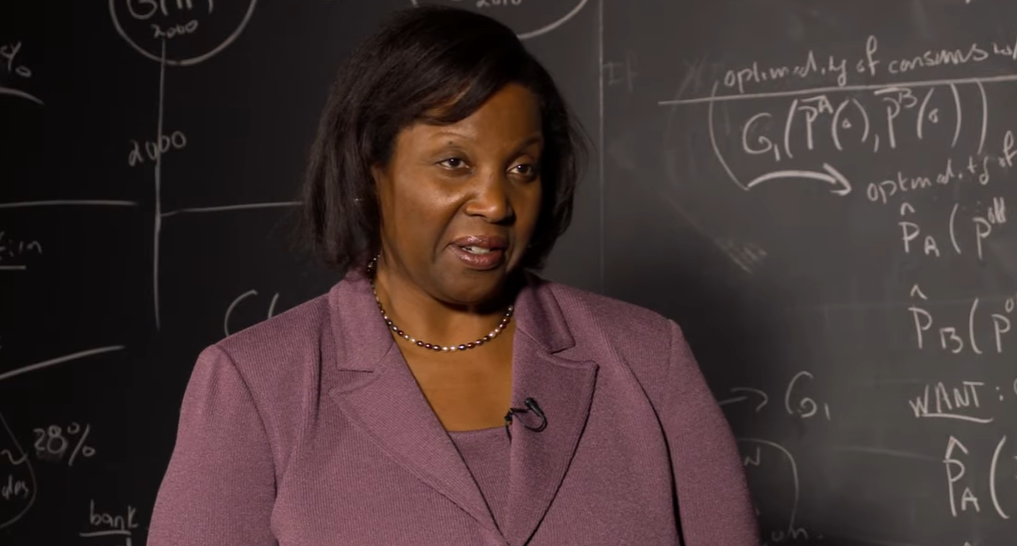

Lisa Cook has established a solid reputation as a thorough economist and an advocate for financial system resilience over the last ten years. She has had a significant impact since joining the board in 2022, especially when it comes to guiding conversations about inflation and labor market stability. A career that many young economists, particularly women and people of color, view as remarkably effective in breaking long-standing barriers is in danger of being derailed by the lawsuit.

Lisa Cook – Key Bio & Case Details

| Field | Details |

|---|---|

| Full Name | Lisa D. Cook |

| Birth Year | 1964 |

| Birthplace | Milledgeville, Georgia, USA |

| Education | Spelman College (B.A.), Oxford University (M.Phil.), University of California, Berkeley (Ph.D. in Economics) |

| Career Background | Professor of Economics & International Relations at Michigan State University; Senior Economist on the Council of Economic Advisers (Obama Administration) |

| Federal Role | Governor, Federal Reserve Board (since 2022; reappointed to full term ending 2038) |

| Historic Achievement | First Black woman appointed to the Federal Reserve Board of Governors |

| Lawsuit | Lisa Cook v. Donald J. Trump et al. (2025) |

| Allegations by Trump | Accused of mortgage fraud related to filings in Michigan and Georgia (no charges filed) |

| Cook’s Claim | Attempted removal violates Federal Reserve Act, due process rights, and Fed independence |

| Judge Overseeing Case | Judge Jia Cobb, U.S. District Court, Washington, D.C. |

| Potential Outcome | May reach U.S. Supreme Court; first-ever legal test of presidential authority to remove a Fed governor |

| Authentic Source | https://www.nytimes.com |

Trump’s attempt to have her removed is not unique. Through official letters and social media attacks, Trump has heightened accusations by working with allies like Bill Pulte at the Federal Housing Finance Agency. Trump declared Cook fired within 30 minutes of Pulte’s allegations going viral online. Critics claim that rather than addressing actual misconduct, this quick escalation is the result of a concerted attempt to scare independent regulators.

The case is especially novel in the context of American democracy because it calls into question the independence of the Federal Reserve Board, a notion that has been accepted for more than a century. Any future discussion about interest rates or inflation policy runs the risk of being hijacked by political demands if presidents have the power to fire governors whenever they want. According to economists, this could destabilize markets by drastically eroding international confidence in US monetary policy.

Given Cook’s professional history, the accusations are all the more perplexing. As the first Black woman to serve on the Federal Reserve Board, a Rhodes Scholar, and a Ph.D. economist, she has continuously shown an exceptionally clear record of public service. She is incredibly dependable, meticulous, and dedicated to economic justice, according to colleagues from Michigan State to the Obama administration. It says volumes about how politics has crept into areas that were previously immune to partisanship that such a person is now involved in legal disputes.

Remote work became commonplace during the pandemic, and Lisa Cook was one of the Fed’s voices advocating for a cautious balance between rate changes and the need to preserve brittle job gains. Her ability to integrate global data sets significantly enhanced her approach, providing perspectives that were surprisingly low in terms of policy cost and extremely efficient. Perhaps it is because of this well-balanced pragmatism that she is currently being targeted.

Historically, the Fed has maintained its independence by cultivating trust across administrations through strategic partnerships. By automating mistrust, Cook’s attempt at dismissal is changing that history. According to legal experts, the Supreme Court may decide the case and establish a precedent that is legally binding. Presidents might be granted broad authority over the Fed if the Court rules in favor of Trump. It could secure more robust safeguards for regulatory independence if it takes Cook’s side.

Securing funding is still a challenge for early-stage startups, and the largest issue facing policymakers in this era is maintaining independent institutions. Cook’s lawsuit has turned into a test case for both her personal integrity and the ability of the US to maintain a system that is remarkably resilient to partisan upheavals.

Even if there were clerical mistakes on mortgage applications, her supporters contend that they happened prior to her appointment and are unrelated to her Fed responsibilities. They interpret this as a deliberate effort to undermine her. Critics counter that the accusations are sufficient to establish “cause.” The conflict here highlights a larger pattern in which accusations stoked by social media become tools of government.

This lawsuit might be seen as more than just a personal conflict in the years to come. It marks a turning point where partisan retaliation and monetary policy independence meet. Society is compelled to consider whether financial institutions can endure the upheaval of political ambition by incorporating these legal discussions into the broader discourse of governance.