Is Americans’ biggest concern affordability? The short answer is a resounding yes, based on both emotional testimonies and extensive polling. Behind that response, however, lies a remarkably complex reality, one influenced by rising grocery costs, declining paychecks, and the expense of just surviving. Because of actual accounts of middle-class families living in greater hardship than ever before, the idea of affordability has subtly gained attention over the past year.

The emotional core of the American public is being shaped by economic insecurity, according to several surveys conducted in recent months. According to a recent Pew survey, 67% of Americans think that the cost of healthcare is a major concern. Millions of individuals are debating whether to postpone a doctor’s appointment or refill a prescription, so that number is more than just a statistic. Additionally, 63% of respondents mention inflation as a national concern when you zoom out. This covers everything, from utilities and rent to groceries and gas.

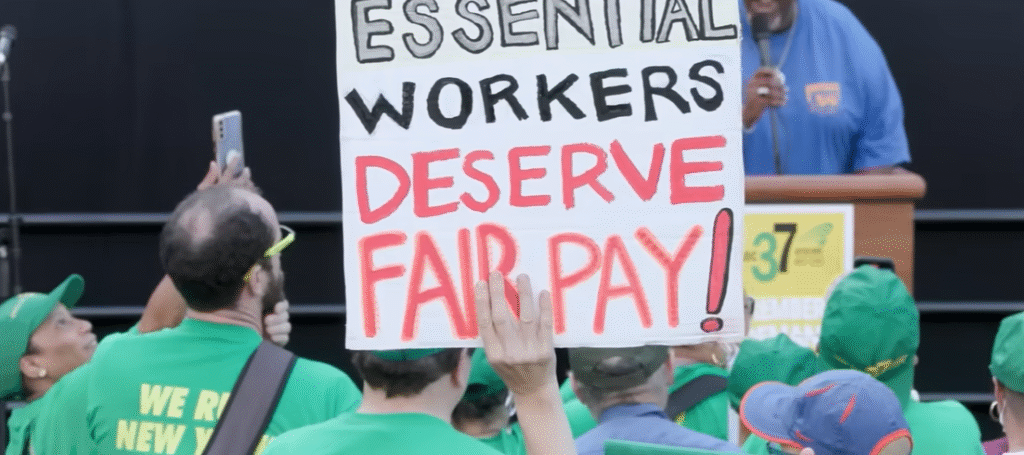

There is no denying that the economy has expanded over the last ten years, but not in a way that directly affects Americans. Despite a nominal increase, wages have not kept up with the rate of daily expenses. As a result, many people believe that stability, which was previously attainable with modest incomes, now necessitates ongoing compromise. Although incredibly useful tools like financial coaches and budgeting apps have surfaced, they frequently only assist individuals in managing a cost structure that has undergone significant change.

Affordability and Economic Concerns in America – 2025 Snapshot

| Key Concern | Percentage of Americans Affected |

|---|---|

| Healthcare affordability | 67% call it a very big problem |

| Inflation | 63% say it’s a top national concern |

| Housing affordability | 74% view it as a serious local issue |

| Federal budget deficit | 57% rank it as a major concern |

| Cost of daily living (food, gas) | 80% express frequent financial stress |

| Source | Pew Research Center: www.pewresearch.org |

Many people were given a temporary reprieve during the pandemic by stimulus payments and postponed loan repayments. That instance provided a preview of what dignity in personal finance could entail. But when that support waned, crushing costs returned, this time combined with inflation and rising interest rates. Mid-size cities like Nashville and Phoenix saw rent increases of over 25% over four years by the start of 2025. In addition to being inconvenient, that kind of escalation is structurally unsustainable.

The working class and those living below the poverty line are not the only groups impacted by affordability. Dual-income households are increasingly reporting that they have “too much month left at the end of the money.” These are reliable professionals who now find themselves counting pennies at the end of each week: nurses, public school teachers, and logistics coordinators. The story of college debt is remarkably similar to this change. What was once thought of as an investment now feels like an unpayable, lifetime bill.

Entrepreneurs and celebrities have started to voice their opinions. Cardi B complained that she feels “robbed every week” by the cost of groceries. Notably, Mark Cuban started Cost Plus Drugs to reduce the price of prescription drugs that can save lives. These answers demonstrate how even the highest ranking individuals acknowledge affordability as a national pressure point, and they go beyond simple brand strategies.

The same worries expressed in Pew or Gallup polling are being echoed by influencers through the use of digital platforms and media reach. This intersection of household realities and elite voices marks a unique convergence in American society. It is a sign that the issue has transcended all boundaries of class, geography, and political affiliation when a mother in Ohio and a business magnate in Los Angeles are conversing about grocery prices.

One of the most glaring examples is still the healthcare industry. More than half of Americans now put off getting care because of the expense, according to a recent KFF report. Stories of parents skipping dental appointments to pay for school supplies or diabetics rationing insulin make that statistic all the more relatable. These daily decisions are destroying mental and physical well-being. Advocates are emphasizing that affordability is a personal crisis rather than a distant policy by incorporating these tales into legislative discussions.

Perhaps the most obvious effect of this change is the affordability of housing. The average renter now spends 30–40% of their income on housing, a significant increase since 2018. Once a sign of middle-class success, homeownership is becoming more and more unattainable for Gen Z and millennials. The starter home market that their parents were able to access with half the income is now out of reach for this generation, which is already burdened with student loan debt.

The statistics speak for themselves when it comes to generational disparities. In the past, Baby Boomers were able to buy homes on their own and send their kids to college. These days, monthly expenses leave little space for savings, let alone emergencies, even for couples with steady dual incomes. What was once a safety net is now a flimsy hammock that oscillates between debt and unfulfilled ambitions.

Additionally, the political ramifications are growing. Affordability has emerged as the main theme of campaign rhetoric in this election cycle. Candidates are promising Medicare expansions, rent freezes, and cost-cutting reforms. Voters, however, are highly skeptical. They’ve heard promises before; now they want policies that provide real, instant relief. The demand for accountability as well as affordability is rising.

Additionally, mental health practitioners observe an increase in stress that is directly related to financial strain. More Americans reported feeling anxious about money over the past year than they did about their jobs, families, or health. This change emphasizes that affordability is now about survival rather than budgeting. Particularly for parents who feel helpless to shield their kids from financial uncertainty, emotional resilience is eroding.

There is cause for optimism in spite of these sobering facts. Innovation is starting to react. Some fintech companies have developed surprisingly low-cost alternatives to traditional banking by utilizing technology. Cooperatives run by the community are making a comeback and providing housing options under local control. Employers are reevaluating benefit packages to include debt support and cost-of-living stipends after realizing that burnout is a financial issue. Despite their early stages, these initiatives are especially helpful in establishing ecosystems of support as opposed to systems of scarcity.

The affordability crisis may lead to a revival of American values in the years to come. The discussion is changing on topics like housing, healthcare, food, and education. People now ask “Why does it cost so much?” in addition to “Can I afford this?” This question, which is being asked more urgently, has the power to change commerce, culture, and policy.