Mitt Romney’s financial success has frequently been characterized as exceptionally successful, based on intelligence, self-control, and a persistent belief in prudent risk-taking. His estimated net worth, which ranges from $250 million to $300 million, is the result of decades of meticulous investment and business strategy that carefully balance measured restraint with market intuition.

Romney shaped an investment firm that became especially inventive in redefining corporate efficiency by co-founding Bain Capital in 1984. He was praised and criticized for his ability to turn failing businesses into successful ones. However, his strategy proved to be very effective in creating long-term wealth and was markedly enhanced by careful restructuring and long-term growth planning.

His career moved from boardrooms to voting booths over the years, but his financial philosophy never changed. From Domino’s Pizza to Staples, Bain Capital’s business endeavors represented his strategic seizing of opportunities. His consistent returns demonstrated a highly dependable intuition for spotting scalable business models that worked incredibly well in both public and private settings.

Romney’s investments grew into a variety of portfolios during the 1990s and the first part of the 2000s, including strategic real estate, mutual funds, and equity partnerships. According to his OpenSecrets financial disclosures, as early as 2018, his holdings totaled over $174 million, including sizeable investments in private investment vehicles and Goldman Sachs funds. These diverse assets, which are organized through blind trusts, exhibit a particularly advantageous balance between caution and openness that is unusual among political elites.

Mitt Romney – Biography and Financial Overview

| Full Name | Willard Mitt Romney |

|---|---|

| Date of Birth | March 12, 1947 |

| Age | 78 (as of 2025) |

| Place of Birth | Detroit, Michigan, U.S. |

| Nationality | American |

| Education | B.A. Brigham Young University; J.D./M.B.A. Harvard University |

| Occupation | Businessman, Politician |

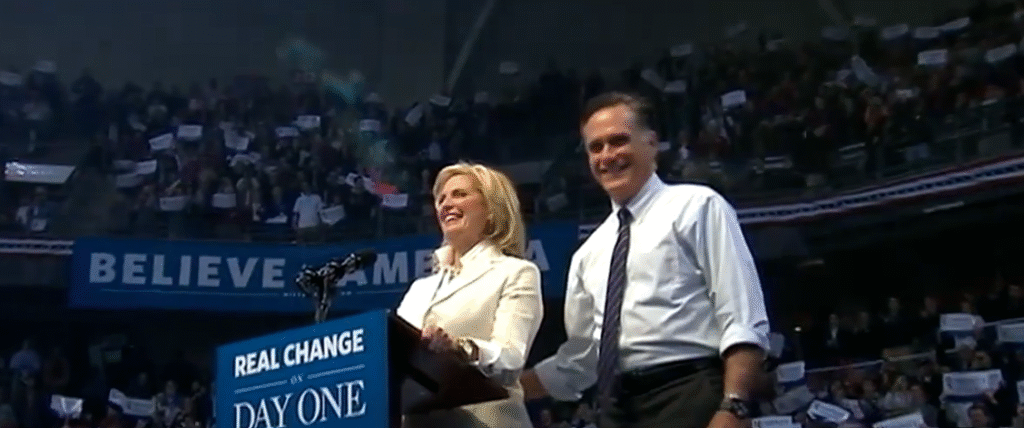

| Known For | Co-founder of Bain Capital, 2012 U.S. Presidential Nominee, U.S. Senator (Utah) |

| Political Party | Republican |

| Spouse | Ann Romney (m. 1969) |

| Children | 5 |

| Estimated Net Worth (2025) | $250 – $300 million |

| Primary Sources of Wealth | Bain Capital Investments, Mutual Funds, Real Estate Holdings |

| Residence | Utah, U.S. |

| Reference | OpenSecrets.org – Mitt Romney Finances |

Additionally, Romney’s wealth highlights a generational continuity that is closely linked to his family’s heritage. He inherited an entrepreneurial rather than extravagant mindset from his father, George Romney, a former auto executive and governor of Michigan. His wealth has remained remarkably stable despite shifting economic cycles thanks to his methodical approach to capital management, which is centered on endurance and efficiency.

Romney’s financial independence has greatly decreased his reliance on donors, observers have observed, giving him a great deal of leeway. During his time in the Senate, when he occasionally stood calmly and firmly apart from partisan currents, this independence was particularly evident. Being financially independent has been especially helpful for him in preserving his political and moral independence.

Romney’s real estate holdings exhibit the same harmony of style and vision that characterizes his business sense. His assets, which include the now-famous La Jolla property with its mechanical car elevator and his Park City ski estate, combine subtle luxury with sensible sophistication. These properties are not just indulgences; rather, they are well-located investments that have seen a significant increase in value over time.

He also has a very adaptable approach to portfolio management. Romney made sure that his assets were protected and profitable by distributing them among a variety of industries. His wealth was exceptionally resilient, even during economic downturns, thanks to his structured risk appetite, which was neither unduly cautious nor recklessly speculative. His post-2008 adjustments are frequently cited by analysts as being especially inventive, demonstrating a willingness to change course rapidly in the face of uncertainty.

Beyond money, Romney’s wealth has social significance. It draws attention to the nuanced connection between political power and economic privilege. Despite his enormous wealth, he has mostly created it on his own through hard work and long-term vision rather than through inheritance or opportunism. This distinguishes him from other political dynasties and places him in the same league as contemporary self-made individuals such as Michael Bloomberg, whose wealth is derived from invention rather than inheritance.

Romney’s wealth story is also framed by his personal ethics. His use of blind trusts, which are supervised by trustee R. Bradford Malt, guarantees that profit and policy are kept apart. Despite being frequently misinterpreted, this structure continues to be a very strong defense against possible conflicts of interest. It serves as an example of how, when managed with integrity, financial transparency can increase rather than decrease public trust.

Romney’s financial independence has given him a voice free from political interference. His ability to put his morals ahead of campaign money is one factor contributing to his moderate, yet firm, position within the Republican Party. Because of his uncommon independence, he represents the fusion of principled governance and disciplined capitalism, which feels especially novel in the divisive environment of today.