Customers are perplexed and even alarmed by recent headlines announcing the closure of Wells Fargo banks. Social media posts stoked rumors of system failures and permanent shutdowns, but the reality is crystal clear: the bank will only be closed for 24 hours on October 13, 2025, in honor of Columbus Day, which is also known as Indigenous Peoples’ Day in many places.

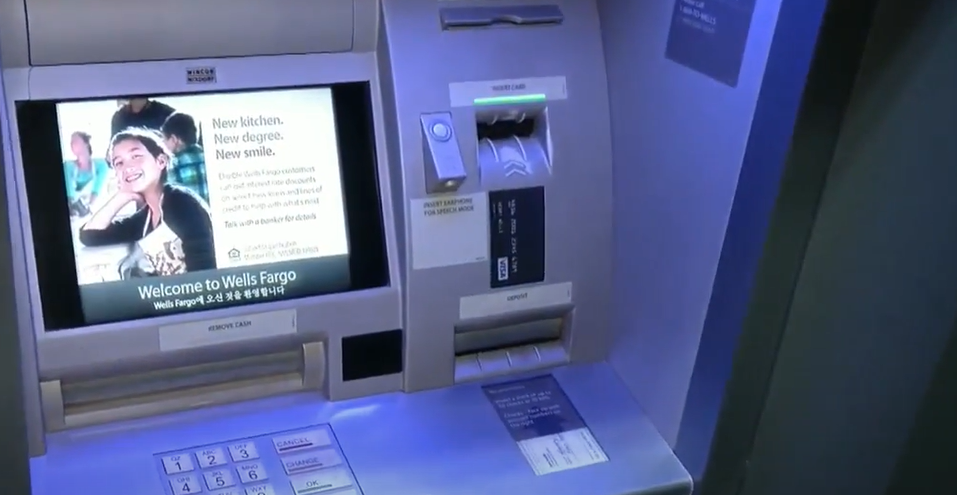

The short-term closure is consistent with a long-standing federal custom. Wells Fargo is just one of many large financial institutions that halt in-person operations on this day each year. While ATMs, mobile apps, and online banking services will continue to be fully operational, the company has confirmed that all 4,300 branches will close for one day. This implies that consumers can continue to make digital deposits, pay their bills, and transfer money without any problems.

However, what appears to be a routine closure has generated a very powerful online debate. Many people took some viral posts literally, reading the phrase “Wells Fargo closing all locations” as an indication of widespread closures or unstable finances. Echoing earlier anxieties about bank failures and economic instability, the panic spread swiftly. This 24-hour pause is actually just the observance of a 1968 federal holiday that coincides with the closing of other government offices.

Wells Fargo — Company Overview and Key Details

| Category | Details |

|---|---|

| Company Name | Wells Fargo & Company |

| Founded | 1852 |

| Headquarters | San Francisco, California, USA |

| CEO | Charles W. Scharf |

| Total Employees | Approximately 227,000 (as of 2025) |

| Industry | Banking and Financial Services |

| Branches in the U.S. | Around 4,300 |

| Closure Date | October 13, 2025 (24-hour nationwide closure) |

| Reason for Closure | Federal holiday observance (Columbus Day / Indigenous Peoples’ Day) |

| Reference | Wells Fargo Official Site |

In accordance with the same schedule, Bank of America, Citibank, PNC Bank, Capital One, and Santander will also cease in-person operations on that day. However, Chase Bank and TD Bank have decided to stay open and provide in-branch services for clients in need of immediate help. The decision highlights the disparities in how different organizations handle federal holidays—some follow tradition to the letter, while others remain open to continue serving customers.

Even though it’s small, the effect on customers is noteworthy. There won’t be any services that need face-to-face communication, like loan consultations, notary verification, or cash withdrawals that exceed ATM limits. In order to maintain business continuity, Wells Fargo recommends that significant financial transactions be finished by October 13 at the latest.

What is noteworthy, though, is how this closure demonstrates how much more resilient digital banking systems have become. A nationwide bank closure would have been a major inconvenience twenty years ago. Customers barely notice the difference these days. Mobile applications now perform tasks that were previously only performed by tellers, and online banking platforms have grown incredibly efficient, handling billions of dollars in transactions every day.

The focal point of this development is Wells Fargo’s mobile banking app, which was revamped under CEO Charles Scharf’s direction. Voice-enabled transactions, same-day transfers, and improved security features are now supported. This technological innovation demonstrates how digital transformation has redefined convenience by guaranteeing that clients maintain access to their finances even when branches temporarily close.

It’s interesting to note that the closure this year takes place during a time when the banking sector is undergoing more extensive structural change. Wells Fargo quietly closed over 30 branches nationwide between March and April 2025 as part of a cost-cutting and modernization initiative. The company now prioritizes smarter, more automated service hubs over more physical locations. This trend, which strikes a balance between community accessibility and digital adoption, is seen by industry analysts as especially innovative.

However, there is a symbolic component to Wells Fargo’s choice to commemorate Indigenous Peoples’ Day. Originally observed only as Columbus Day, the holiday has changed, particularly in states like California, Washington, and Oregon, where it is now observed to honor Native American cultural contributions and heritage. By commemorating this day, Wells Fargo and other financial institutions are joining a growing cultural consciousness that aims to value inclusivity and diversity over outmoded historical narratives.

Even though this change is subtle, it represents a larger cultural shift in how businesses approach social responsibility. Financial institutions are readjusting their public image through community outreach and thoughtful observances, much like Nike and Apple have publicly pledged to promote cultural equity. Wells Fargo’s October 13 closure is a modest but incredibly powerful gesture that recognizes shifting times and shared values, going beyond simply adhering to federal law.

However, some clients—particularly small business owners who depend on physical branches for cash deposits and payroll processing—have complained about timing. The majority of needs are met by digital services, but some transactions still call for human contact. According to an entrepreneur from Phoenix who spoke to The Economic Times, “it’s just one day, but when you manage dozens of employees, even 24 hours can feel like a lifetime.”

Chase and TD Bank’s decision to remain open offers a surprisingly cost-effective substitute for clients like her, enabling continuity without significant disruption. However, experts point out that Wells Fargo’s dedication to set timetables has long fostered trust among loyal clients who value consistency over flexibility.

The October closure raises a deeper query than just the customer experience: what does “banking access” mean in the digital age? Accessibility now depends more on connectivity than location as automation, mobile finance, and artificial intelligence continue to transform the sector. This broader shift, which combines technological accuracy with human interaction, includes Wells Fargo’s digital strategy, which aims to build an extraordinarily adaptable ecosystem.