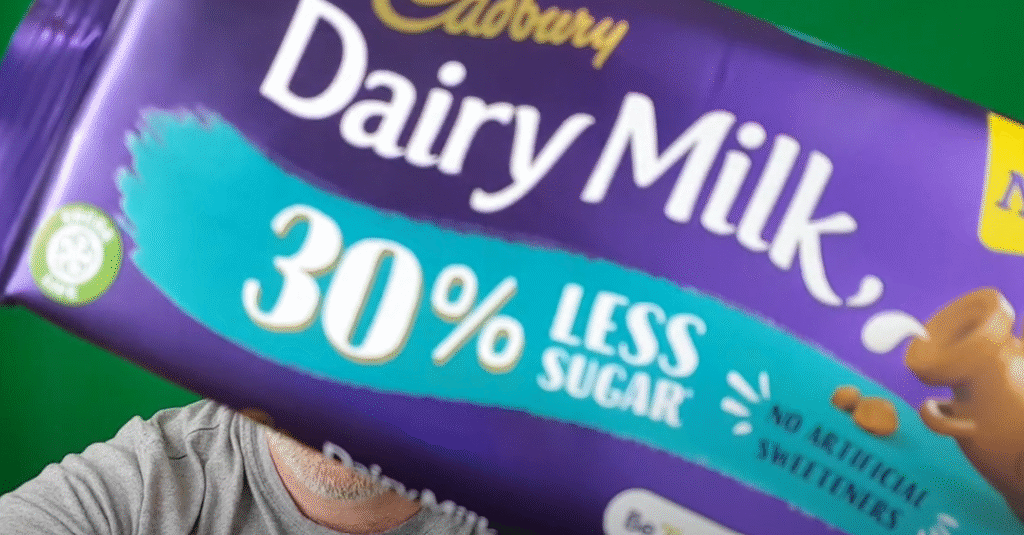

Cadbury dubbed its dairy milk with 30% less sugar the biggest innovation in its history when it first announced it in 2019. The promise that indulgence could be healthier without sacrificing familiarity was symbolized by the bar. The reduced-sugar version was designed to update the decades-old cultural memory that was contained in its purple wrapper. Even though Mondelez invested heavily in research and advertising, it acknowledged that sales had drastically decreased and confirmed its discontinuation just four years later.

A significant discrepancy between what customers claim to want and what they actually select was exposed by the development of 30 Less Sugar Cadbury. People still prefer the original, creamier bar when they are in the aisle, despite the fact that polls consistently show that people want healthier options. The failure bore a striking resemblance to the green-bottled compromise, Coca-Cola Life, which combined sugar and stevia but vanished after poor sales. The concept was well received by customers, but they did not support it financially.

Health authorities’ mounting pressure prompted the action. Since the World Health Organization cut the recommended sugar intake in half in 2015, food companies have been under increasing pressure to lower sugar levels across the board. Cadbury was expected to react as a well-known chocolate manufacturer because confectionery was specifically targeted. The company’s innovative introduction of a reduced-sugar bar devoid of artificial sweeteners showed its dedication to combating obesity.

30 Less Sugar Cadbury – Product Information

| Category | Details |

|---|---|

| Brand | Cadbury (owned by Mondelez International) |

| Product | Cadbury Dairy Milk 30% Less Sugar |

| Launch Year | 2019 |

| Discontinued | 2023 |

| Key Feature | 30% less sugar than classic Dairy Milk, no artificial sweeteners |

| Market Availability | UK and Ireland |

| Purpose | Health-conscious alternative to standard Dairy Milk |

| Reception | Mixed – praised for innovation but criticized for texture and taste |

| Legacy | Seen as a “failure case study” in reduced-sugar confectionery |

| Official Reference | Mondelez scraps lower-sugar Cadbury Dairy Milk |

However, it was more difficult to reformulate chocolate’s sensory experience than that of drinks or snacks. For many devoted customers, the new bar lacked the creamy, melt-in-mouth texture of traditional Dairy Milk, and taste is still paramount. Some said it was a little grainy, while others said it wasn’t as good. “Nearly the same” is insufficient in an indulgence. For a product that was linked to childhood memories, birthdays, and nostalgia, even a slight alteration felt like a betrayal.

Additionally, marketing was crucial. By focusing on “less sugar,” Cadbury positioned the bar around subtraction as opposed to addition. Compare that to more aspirational brands that emphasize “fruitier ingredients” or “more protein.” It is common for consumers to react more favorably to abundance than to reduction. Although it was very obvious that health was a priority, it had trouble evoking strong feelings. Beyoncé promotes Pepsi with glitz rather than moderation; indulgence thrives on vigor rather than restraint.

Retail positioning made the problem even worse. High-sugar food regulations in the UK limited the places in which they could be displayed. Paradoxically, the reduced-sugar bar was frequently marginalized rather than positioned in prominent checkout areas. Because of this, fewer people made the impulsive purchases that account for a large percentage of candy sales. Policies intended to promote healthier eating actually worked against products that attempted to achieve those objectives.

The difficulties faced by other confectioners were comparable. With a 30% lower sugar content thanks to an innovative “hollow sugar” process, Nestlé’s Milkybar Wowsomes were only available for two years before going out of business. Reduced-sugar chocolate is in an awkward place because it is neither decadent nor healthful enough, as even industry titans with decades of experience and substantial resources have found. Customers find it simpler to indulge in the traditional bar and reduce their calorie intake in other ways.

However, the effects of 30 Less Sugar Cadbury shouldn’t be written off as worthless failures. The intersection of emotional attachment and health trends was tested in real time. It demonstrated to brands that consumers require not only a redesigned product but also a fresh story that redefines luxury. Because they sell an identity—sophistication, authenticity, and richness—rather than moderation, artisanal chocolatiers that produce bars with higher cocoa and naturally lower sweetness levels, for instance, are successful.

There is more to the story than chocolate. Although they make headlines, fast-food chains’ “lite” menus hardly ever sell as well as their classics. Despite the promotion of low-ABV beers by alcohol companies, consumers continue to seek out strong lagers for social gatherings. The difficulty of changing iconic products without lessening their emotional significance is highlighted by these similarities. The lesson is obvious: redefining indulgence itself is the key to true success rather than subtracting.

A conflict between aspiration and action is reflected in society through the disappearance of 30 Less Sugar Cadbury. Despite consumers’ concerns about obesity and awareness of health risks, convenience, comfort, and nostalgia still prevail. The need for more significant changes—policy incentives, cultural education, and perhaps most importantly, innovation that adds value rather than merely takes it away—is highlighted by this paradox.

Since then, Cadbury has shifted to natural inclusions rather than simplified formulas, focusing on alternatives like Fruitier and Nuttier bars. Offering a new product instead of a “lighter” version of an old one could significantly improve the connection with customers. Customers are aware that they would rather receive more than less.