The class action lawsuit against H&R Block has proven to be a very successful wake-up call regarding the way private companies manage private taxpayer data. While promising consumers that their information was secure, H&R Block is accused of using embedded tools like Meta Pixel and Google Analytics to covertly send private financial information to technology partners. Many find this betrayal to be remarkably similar to the Cambridge Analytica scandal, in which people discovered their trust had been exploited.

Private lawyers and federal regulators have taken up the matter with renewed vigor in recent days. The alleged wrongdoing is presented in the RICO lawsuit against H&R Block, Meta, and Google as a part of a purposeful racketeering pattern rather than as an unintentional oversight. This framing is especially novel because it treats digital privacy violations as systematic exploitation as opposed to straightforward breaches. By using this legal tactic, plaintiffs have significantly increased their chances of receiving triple damages, which could result in settlement offers that are significantly higher than the millions currently being offered.

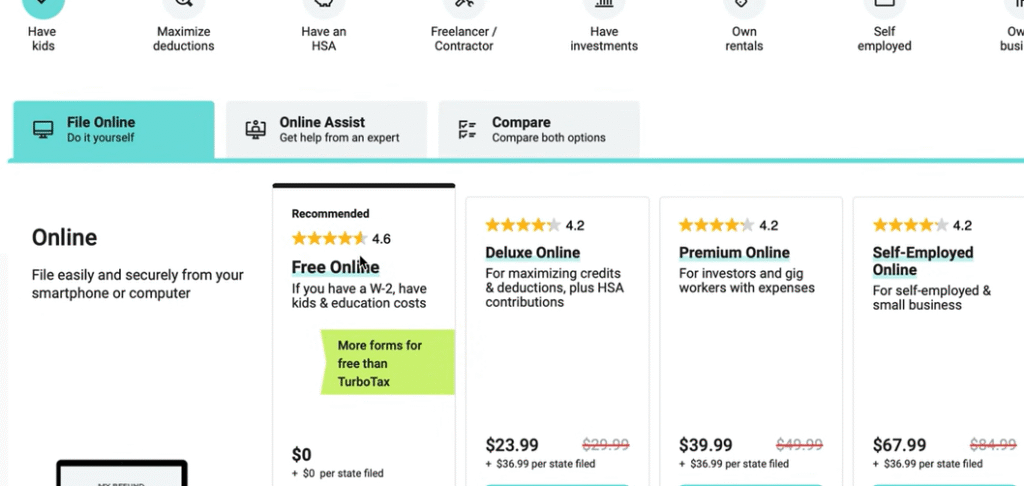

A $7 million order from the FTC has already been finalized, mandating that H&R Block stop unfair downgrading practices, false free-filing claims, and the destruction of customer data. Even though this settlement was small in comparison to the amount of the alleged damages, it was very effective in creating precedent. The fact that government organizations are becoming more prepared to challenge financial service firms regarding digital transparency was also made abundantly evident.

Table: H&R Block – Company Information and Legal Challenges

| Detail | Information |

|---|---|

| Company Name | H&R Block, Inc. |

| Founded | 1955 by Henry W. Bloch and Richard Bloch |

| Headquarters | Kansas City, Missouri, USA |

| Industry | Tax Preparation, Financial Services |

| Services | Tax return preparation, digital tax filing, business services |

| Employees | Approximately 2,500 corporate staff, with 60,000 seasonal tax professionals |

| Legal Issues | Accused of sharing tax data with Meta and Google, deceptive “free” filing |

| Notable Settlements | $19.4M IRA settlement, $62.5M Cummins settlement, $7M FTC order |

| Current Class Action | Filed under RICO Act, alleging unlawful disclosure of sensitive tax data |

| Reference Link | FTC.gov |

There has been a particularly strong public response to the case. Customers believe that their names, incomes, deductions, and even dependents were used as marketing data without their knowledge or consent. Being aware that such information might have been shared for commercial purposes can have a profoundly personal emotional impact. When compared to celebrity data leaks, it is extremely adaptable; just as Hollywood celebrities have struggled to recover control over stolen images, regular taxpayers now have to contend with the same struggle for control over their digital identities.

Online tax filing increased during the pandemic, and remote work became commonplace. This change greatly benefited H&R Block, but the lawsuit alleges that the company also took advantage of the opportunity to covertly increase data-sharing pipelines. The business’s standing as a trustworthy brand has suffered greatly in the eyes of consumers. Once presented as a yearly civic duty, tax season is now marred by uncertainty about the possibility of private data being smuggled into the advertising industry.

According to lawyers, damages might cover things like compensation for credit monitoring, restitution for losses resulting from fraud, and compensation for the anxiety the breach caused. In civil law, if the accusations of racketeering are proven, punitive damages may also be taken into account. Plaintiffs are aiming for both monetary compensation and a change in the way tax services interact with digital marketing behemoths through strategic alliances with several law firms.

There are numerous societal ramifications. Consumers may become more interested in government-backed filing systems if they lose faith in private tax services. The IRS has already tested free filing platforms, and public support may increase as a result of this controversy. Similar to how the Wells Fargo account scandal changed the way consumers bank, the H&R Block crisis may change how taxes are prepared.

Celebrities who have spoken out about their control over their digital likeness, such as Scarlett Johansson and Taylor Swift, demonstrate that privacy rights are a universal issue. People, whether they are taxpayers or performers, want to be sure that their personal information won’t be used without permission. These parallels are remarkably similar. These stories, which range from pop culture to finance, combine to form a single, more comprehensive call for accountability.

Customers’ increased voice regarding digital transparency over the last ten years has pushed companies to make changes. This case exemplifies that general trend, especially with its novel RICO strategy. Data misuse cases are becoming high-stakes litigation as lawyers combine privacy law with racketeering frameworks.

The verdict in this case is probably going to be used as a standard in the upcoming years. Companies that use tracking codes like Meta Pixel may be subject to a much quicker road to reform or penalties if the court rules in favor of the plaintiffs. The message to consumers will be very clear: privacy is a protected right, not a privilege.