Kristine Divney didn’t anticipate getting caught up in a legal battle when she downloaded the Caviar food delivery app and chose to use Apple Pay because she thought it was a safe, Face ID-verified method. But on May 29, 2025, she found a $9.99 DashPass subscription charge that she claims she never authorized, and that’s exactly what happened. Her experience has evolved from a single tech glitch to the focal point of a quickly expanding class action lawsuit accusing Apple Pay and DoorDash of engaging in dishonest business practices.

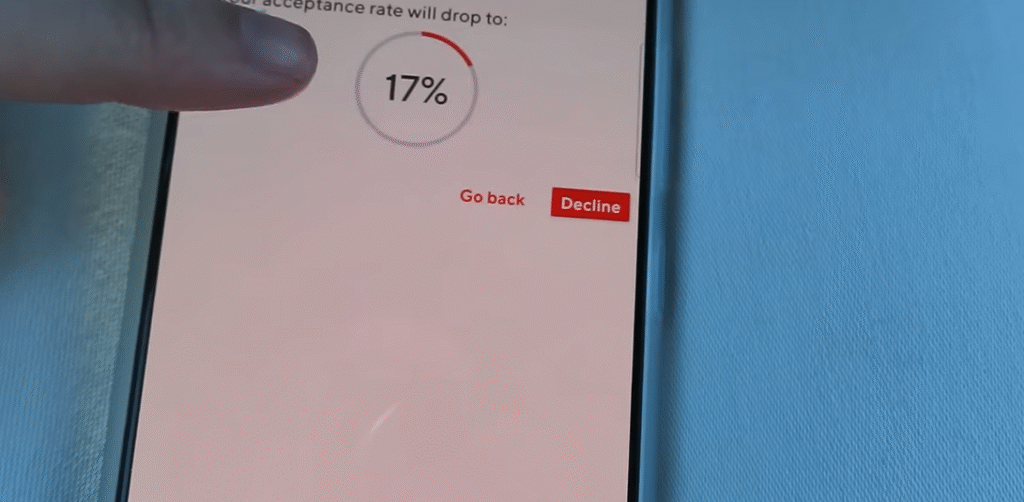

She filed a lawsuit in June, claiming that Apple Pay enabled the charge without requesting the required Face ID authentication, in addition to DoorDash charging her without her consent. This is especially problematic for consumers. Apple Pay has long marketed itself as a very effective, biometric-secure payment method. To be honest, it is unsettling to think that it might permit recurring subscription payments without biometric verification. This situation evokes remarkably similar concerns that were present when Amazon was sued for its auto-renewing Prime subscriptions, particularly for users who depend on facial recognition to maintain financial integrity.

Complaints have been flooding legal forums, comment sections, and Reddit threads in recent days. According to some users, they received a bill months after canceling. Others say they didn’t realize the charges until they looked back at forgotten transactions, many of which were surprisingly cheap to ignore—until they added up over time. One irate customer said that in order to stop the repeated charges, they had to completely cancel their debit card. Unquestionably, that is a bold but telling step.

| Detail | Information |

|---|---|

| Plaintiff | Kristine Divney |

| Defendants | DoorDash Inc. (doing business as Caviar), Apple Payments Services LLC |

| Court | Supreme Court of the State of New York, County of New York |

| Case Number | 653442/2025 |

| Lawsuit Filed | June 6, 2025 |

| Key Allegation | Unauthorized DashPass subscription charges via Apple Pay |

| Charge Amount | $9.99 per subscription |

| Payment Platform Used | Apple Pay |

| Lawsuit Basis | New York Consumer Protection Act, General Business Law |

| Additional Claims | Negligence, Fraud, Unjust Enrichment |

| Reference Website | https://topclassactions.com |

DoorDash may have created an ecosystem that allowed for significant billing errors in addition to being extremely convenient by utilizing its smooth integration with Apple Pay. This case serves as a potent reminder to tech developers and early-stage entrepreneurs that user consent should never be sacrificed for operational convenience. Additionally, it draws attention to the fact that even the most secure systems can have unintended dangers for regular users.

Among other laws, Divney’s lawsuit lists infractions of the General Business Law and the New York Consumer Protection Act. Both businesses are also charged with negligence and unjust enrichment in this case. Fundamentally, the lawsuit contends that users were not only wrongfully charged, but that the system as a whole was built in a way that made it extremely challenging to identify and reverse such charges. Although it’s a bold assertion, the public is beginning to accept it.

The topic of “dark patterns”—digital design decisions that gently encourage users to take actions they may not fully comprehend—is one especially creative legal angle. Regulators have been paying more and more attention to these trends, and this case may finally bring them into the public eye. The lawsuit challenges the very architecture that allowed the unauthorized charge against one woman, not just the charge itself, thanks to clever legal framing.

The case presents an awkward conundrum for influencers and celebrities who regularly advertise services like DoorDash. In an effort to disassociate themselves from Instagram, some users have already stated that they only endorse “transparent brands.” The growing significance of brand accountability in influencer culture is demonstrated by this subtle reputational backpedaling. Public personalities are expected to support platforms that adhere to incredibly clear ethical standards as they grow more conscious of the reputational risk involved in endorsing digital products.

Growing class action lawsuits over the past few months have highlighted a larger conflict between consumer protection and rapidly advancing technological innovation. Businesses that previously had minimal oversight are now frequently defending their actions in court. For good reason, the public is growing impatient with ambiguous terms of service and unexpected fees. Even though these fees are small on their own, they become especially detrimental when applied to large user bases.

In addition to drawing attention to her personal grievance, Kristine Divney’s lawsuit reflects a sentiment that is remarkably common among digital consumers: a loss of agency. People are curious about what they are paying for and why. And trust starts to erode when biometric security measures aren’t enough to keep them safe. An entire industry based on automation and low friction is negatively impacted by this erosion, not just DoorDash or Apple.

It is anticipated that platforms will implement more stringent authentication procedures and permit more detailed controls for subscription management as a result of the legal actions. This case could be a watershed in the years to come. Businesses can become much more user-centered and protect themselves from legal risk by implementing layered verification techniques, such as requiring Face ID confirmation for all subscriptions.

If approved as a class action, the lawsuit will demand significant reform in addition to damages. Furthermore, the timing couldn’t be more appropriate. Consumer advocacy organizations are advocating for updated legislation that guarantees digital payment platforms are subject to the same transparency standards as traditional banking institutions, given the rapid evolution of financial technology.

User annoyance is still growing even though Apple and DoorDash have not yet made any significant comments regarding the ongoing lawsuit. Thousands of people who were previously unaware of their vulnerability have been inspired by stories like Divney’s. There are probably hundreds of people who are unaware of a mysterious $9.99 charge for every person who notices it, unwittingly supporting a passive billing revenue stream.

Convenience must never take precedence over consent, according to Divney’s case, which challenges this ecosystem. A growing demand for ethical user design—one where subscriptions are transparent, optional, and simple to cancel—is reflected in her story, which has been shared widely across platforms and legal networks.

The public’s reaction has been intense, if not outraged, thus far. Legal experts believe that if this case compels Apple to reconsider how its Face ID works with recurring charges, it may spark broader reform. Millions of people could be spared additional unintended payments if that change alone were to spread throughout digital commerce.