Although the name Nexstar Media Group is becoming more and more common in American homes, it is oddly not mentioned at many kitchen table discussions. From a single station in Pennsylvania when Perry Sook founded it in 1996, it expanded into a massive broadcasting conglomerate that currently owns or runs over 200 stations. The company has quickly woven itself into the fabric of American media, with its headquarters located in Irving, Texas, and other offices in New York and Chicago. It has carefully expanded into markets that were previously thought to be unreachable by making acquisitions, much like a shrewd chess player.

The transition is remarkably similar to Netflix’s stealthy transition from DVD rentals to streaming supremacy worldwide. After acquiring Media General in 2016 and Tribune Media in 2019, Nexstar went on to acquire Tegna in a $6.2 billion deal that would give it 265 stations that would reach almost 80% of American households. Given that both businesses perfected the art of mass purchasing and changed the rules of the industry, the analogy to Disney’s acquisition binge in the entertainment sector is especially fitting.

Perry Sook is the quintessential example of the quiet tycoon. In contrast to flamboyant individuals like Rupert Murdoch, Sook has maintained a low profile, but his impact has been remarkably evident. Since local news anchors and sports coverage are still very important to communities, he founded Nexstar on the localism tenet. He achieved this by developing a business strategy that is not only incredibly effective but also remarkably resistant to the streaming tide.

Nexstar Media Group – Company Profile

| Category | Details |

|---|---|

| Company Name | Nexstar Media Group, Inc. |

| Founded | June 17, 1996, Irving, Texas |

| Founder | Perry A. Sook |

| Headquarters | Irving, Texas; New York City; Chicago |

| Key Executives | Perry A. Sook (Chairman & CEO), Michael Biard (President & COO), Lee Ann Gliha (CFO) |

| Industry | Media and Broadcasting |

| Major Assets | 265+ TV stations (post-Tegna deal), The CW Network, NewsNation, Antenna TV, Rewind TV, WGN Radio, The Hill |

| Revenue (2024) | $5.4 billion |

| Employees | ~13,000 |

| Market Position | Largest owner of local TV stations in the U.S. |

| Authentic Source | www.nexstar.tv |

According to this interpretation, Nexstar’s acquisition of The CW Network is a declaration of intent rather than just a business transaction. Once a haven for teen dramas, the CW has changed under Nexstar to focus more on sports and other programming, a move that reflects both market demand and strategic innovation. By supporting national programming and utilizing local affiliates, Nexstar created an ecosystem that is exceptionally adaptable and exceptionally lucrative. In comparison to competitors like Sinclair and Gray Media, this hybrid approach has significantly strengthened its position in the market.

The company’s particularly inventive approach is highlighted by NewsNation, another gem in its portfolio. It marketed itself as “News for All Americans” and claimed a balanced viewpoint in an effort to set itself apart from divisive networks. Although some critics are still dubious, Nexstar’s expansion shows how it capitalizes on the public’s desire for less contentious reporting. This positioning feels bold and astute in light of the growing mistrust of the media.

One cannot overlook the company’s digital footprint. Nexstar has quietly entered the digital advertising market, which was previously thought to be the sole purview of tech giants, with more than 120 local websites and almost 300 mobile apps. Small businesses now have access to data-driven campaigns that were previously only available to corporate giants thanks to the integration of advanced analytics, which optimized local ad sales. This tactic has been incredibly successful in creating new sources of income and strengthening ties within the local community.

Its acquisition of The Hill, a significant political publication in Washington, highlights Nexstar’s aspirations on a national scale. The comparison here moves from traditional broadcasting to contemporary influence-building: it’s like a local supermarket chain invested in Whole Foods out of the blue. Now that Nexstar has direct access to legislators, lobbyists, and digital-first consumers thanks to The Hill, its dependency on traditional television ratings is greatly diminished.

The growth of Nexstar is indicative of a larger social trend: the concentration of local media in a smaller number of hands. While some criticize the homogenization of content, others contend that Silicon Valley’s platforms are just too big for businesses the size of Nexstar. In many respects, Nexstar is balancing aggressive expansion with protecting the delicate local journalism ecosystem. Its approach, which ensures survival through expansion, is similar to a farmer protecting crops while also purchasing more land.

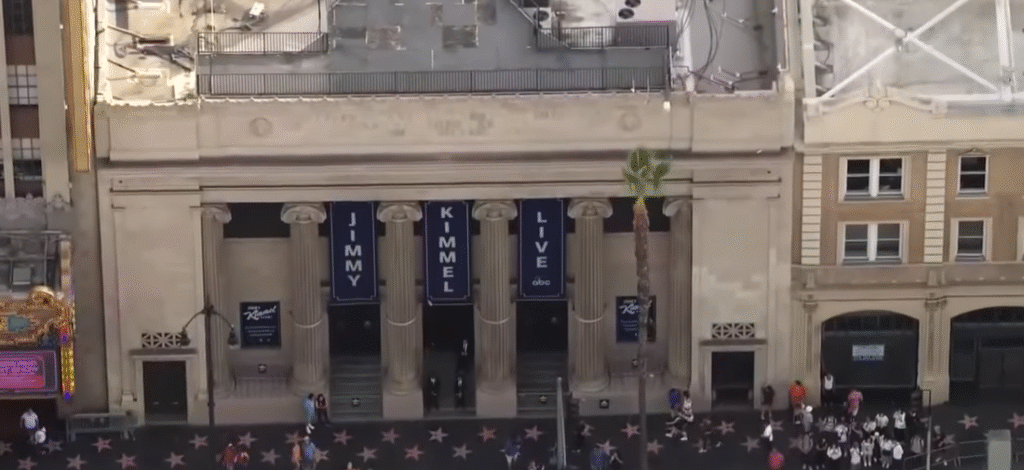

The cultural influence is already apparent. One company’s influence was recently shown when Nexstar chose to preempt Jimmy Kimmel Live! on its ABC affiliates due to comments it considered offensive. This choice, which had an impact on late-night television, demonstrated that Nexstar’s influence goes well beyond local weather forecasts. Previously the domain of Hollywood behemoths, it now occupies the nexus of politics, entertainment, and social norms.

The effect is subtle but significant for audiences. In Milwaukee or Tampa, the anchor who reads your nightly news is supported by the same corporate entity that controls national conversations in Los Angeles and Washington. The ability to target both coast-to-coast and hyper-local audiences with equal ease makes this duality especially advantageous for advertisers. It provides viewers with continuity through the well-known faces of regional anchors backed by an extensive, well-funded infrastructure.