In addition to its monetary worth, the $6.94 million Canteen vending machine class action has garnered a lot of attention because of the precedent it sets for automated retail pricing. Its central allegation is that some vending machines run by the Compass Group charged consumers using credit, debit, or prepaid cards more than the listed price—without making that clear. Even though the sums involved in each transaction were modest, the pattern over several years of sales made the case worthy of a settlement.

The eligibility requirements have become very clear in recent weeks. Between 2014 and July 9, 2025, anyone who paid with a qualifying card at a specific Canteen vending machine could get anywhere from $30 to $360. Frequent users are particularly rewarded by this tiered compensation structure, which acknowledges that prolonged reliance on these devices probably increased the hidden cost over time.

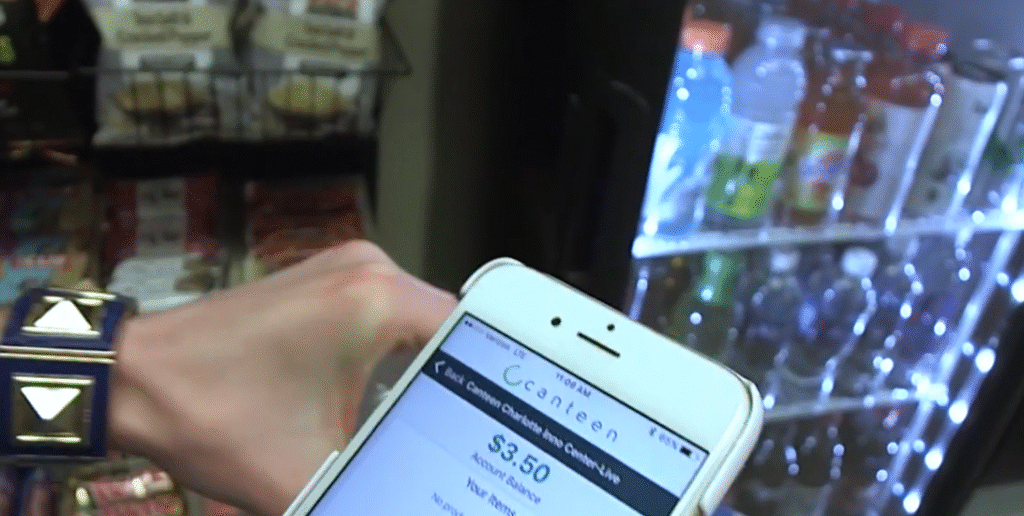

The machines in question all had the same characteristics: they took both cash and credit cards, but they didn’t display card-specific prices unless they had a cash discount label, printed the prices side by side, or had a digital checkout that showed the actual amount. Because it guarantees that the settlement focuses on actual transparency violations rather than general payment processing fees that are accepted as normal in other industries, that distinction is especially crucial.

Canteen Vending Machine Class Action – Key Settlement Details

| Field | Details |

|---|---|

| Defendant | Compass Group USA Inc. d/b/a Canteen |

| Settlement Amount | $6.94 million |

| Claim Amount Range | $30 – $360 |

| Allegations | Charging more than displayed price for card payments without disclosure |

| Eligibility Period | 2014 – July 9, 2025 |

| Eligible Purchases | Credit, debit, or prepaid card transactions at certain vending machines |

| Claim Deadline | November 14, 2025 |

| Opt-Out / Objection Deadline | October 17, 2025 |

| Final Approval Hearing | January 9, 2026 |

| Payment Methods | PayPal, Venmo, Zelle, or paper check |

| Reference Website | https://vendingmachinesettlement.com/ |

Through the use of structured negotiations, lawyers were able to obtain a fund that would be used for administration, legal costs, and a small service award of $10,000 for the lead plaintiff. The remaining funds would then be distributed to claimants or designated charities. Since it does away with the controversial practice of giving back unclaimed money to the defendant, this strategy is especially advantageous for preserving public confidence.

The wider meaning goes well beyond vending machines. In other industries, such as entertainment ticketing, where artists like Taylor Swift have openly criticized opaque pricing structures, it echoes well-known discussions about “hidden fees.” The parallel is remarkably similar: customers assume that the price they see represents the total cost, and any variation without explicit disclosure could erode trust.

This settlement, in the opinion of many, also highlights how payment preferences are evolving. Due to a sharp decline in cash usage in recent years, particularly following the pandemic, card payments are now the norm for routine purchases. Due to this change, card-specific surcharges now affect the majority of consumers rather than a select few, which makes transparency even more crucial.

With digital submission options and contemporary payout methods like PayPal, Venmo, and Zelle guaranteeing quick distribution after the court gives final approval, filing a claim is incredibly efficient. Although consumers have a realistic window of time to take action, early participation could speed up payment following the hearing on January 9, 2026. The claim deadline is November 14, 2025.

According to industry analysts, Compass Group, a major player in the food services industry with thousands of vending machines across the country, may undergo operational changes as a result of the settlement. Possible adjustments could include more obvious dual pricing displays or unified pricing regardless of payment method, both of which could significantly enhance brand reputation.

Vending machines gained popularity as contactless, unattended retail locations during the pandemic. The impact of unreported surcharges was probably increased by this increased usage, which also increased the number of impacted customers. In this way, the settlement acts as a reminder that increased demand inevitably leads to increased scrutiny in addition to providing restitution.

Along with cases involving quick-service restaurants, ride-sharing apps, and online marketplaces, the case also adds to an expanding list of settlements related to point-of-sale transparency. Each supports the notion that, even in transactions involving small amounts of money, pricing clarity is now required and not optional.

The lesson for the typical consumer is straightforward: minor fees add up over time. Consistent overcharging in vending machines can result in multi-million dollar settlements, much like microtransactions on millions of accounts can lead to significant lawsuits. The Canteen case turns a routine purchase into a potent illustration of how consumer awareness and legal action can result in both change and compensation.